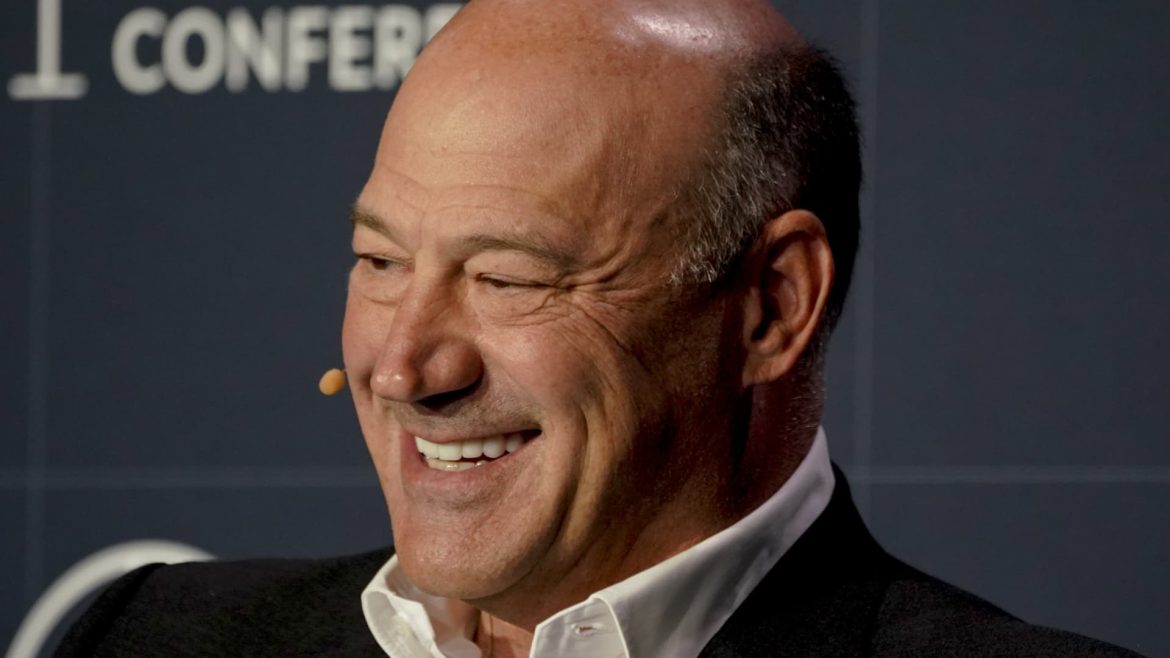

Title: U.S. Economy Reaches Normalcy, Market Misjudging Pace of Interest Rate Cuts, Says IBM Vice Chairman

The U.S. economy has finally returned to normal after two decades, according to International Business Machines Corp. (IBM) Vice Chairman Gary Cohn. However, the market seems to be overestimating the pace at which interest rate cuts are likely to occur.

Market Misjudgements

Cohn pointed out that the market is narrowly pricing in the first rate reduction from the Federal Reserve in May 2024, with approximately 100 basis points of cuts expected throughout the year, according to CME Group’s FedWatch tool.

In contrast, Cohn does not anticipate the Fed will start unwinding its position until at least the second half of the following year. He believes that similar moves from other major central banks will prompt the Fed’s decision, as other central banks began hiking rates sooner.

Economic Indicators

Despite the recent consumer price index increase of 3.2% in October from a year ago, Cohn highlighted the resilience of the U.S. economy, which has so far avoided a widely predicted recession. He remains hopeful that this resilience will allow the Fed to bring down inflation to its 2% target without triggering an economic downturn.

The Economic Landscape

Cohn also discussed the current economic landscape, highlighting that U.S. consumer debt has soared to record highs of over $1 trillion. He emphasized that consumer spending is persisting despite tightening financial conditions, stating that the consumer and the broader economy are “back to normal, but we all forgot what normal is.”

Inflation and Interest Rates

Cohn noted that the 10-year U.S. Treasury yields, with a 100-year average of around 4.5%, have moderated from the 16-year high of 5% logged in October to around 4.3%. Additionally, inflation is “running back towards the mean” of between 2% and 2.5%.

Looking Ahead

Cohn expressed confidence that every piece of economic data, if examined, is heading back towards its very long-term average. He emphasized, “If you look at these over 100-year generational cycles, we seem to be running into that phase right now.”

In conclusion, Cohn’s insights suggest that the U.S. economy has made substantial progress, and he holds the view that the market may be underestimating the timing and pace of future interest rate cuts by the Federal Reserve.

I have been featured in numerous publications, both online and offline, and am a regular speaker at industry events. I am also the founder of Crypto University, an online educational platform that helps people learn about cryptocurrencies and blockchain technology. In addition to my writing and teaching career, I am also an active investor in the cryptocurrency space. I have made investments in some of the leading projects in the space, and my portfolio has outperformed the market by a wide margin